Five tips to help you improve your credit score

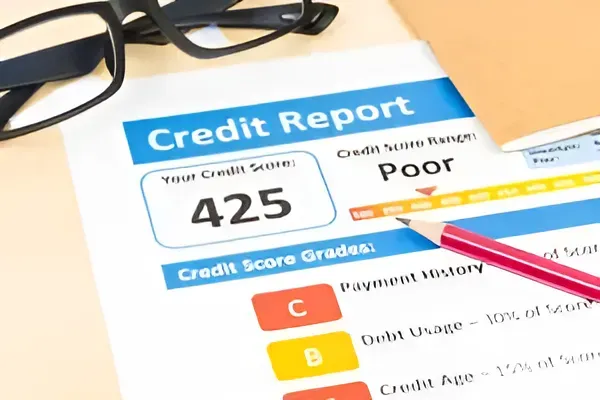

When the time comes for you to get a loan, the first thing a lender will do is look at your credit score.

It is a number between 0 and 1200 that is calculated by information available in your credit report and it lets credit providers know how responsible you are to lend to. The higher your score, the more likely you are to repay the loan.

With any loan comes risk and a lender will want to determine this level of risk before they lend to you. With your credit score determining how much finance you will receive and whether you will be approved or denied, it’s crucial to ensure you have and maintain a good credit score.

How do you protect or improve your credit score? Here are five tips to make sure you are in the best position to secure any future loans you may need.

1. Keep your loan enquiries to a minimum

What a lot of people don’t realise is that every time you apply for credit or a loan – regardless of the amount – an enquiry is left on your account showing that you have applied for credit.

If there are too many enquiries on your account, or a series of loan requests close to each other, a lender may wonder if this is because other lenders have declined your request for a loan and you’ve had to ask someone else.

They start to think others may know something about you that they don’t and consider you a high-risk borrower. While this may not be the case at all, it is important to keep this in mind. Before you apply for your next loan or credit card ask yourself if you really need it and if you are in a position to repay it now. If not, forget it.

2. Lower your credit card limits

The higher your credit card limit, the harder it will be to get a good credit score. You may find, like many others, that your bank keeps offering you higher credit card limits without you asking for them. While this can seem like a good thing, in many ways it is a trap.

Not only is it more tempting to spend money you don’t have keeping you in the debt cycle for longer, it can also affect your credit score. Whatever credit limit you are approved for, regardless of whether you are using it, will be classified as your debt amount. If you are approved for a large amount of credit that you are not using at the moment, bring it down as low as possible.

3. Pay your bills and repayments on time

Your credit score is dynamic, which means it changes from month to month depending on your circumstances. The good news is that you can start making positive changes to your credit score in a short amount of time. One way to do this is to pay your bills and credit card repayments on time.

If a budget doesn’t work well for you, consider setting up automatic payment schedule for regular bills and scheduling alarms in your calendar, to-do list or phone for bill due dates as bills arrive. A little pre-planning will ensure you keep your payments on track.

4. Pay your credit card off in full each month

Credit cards can be incredibly useful when used the right way, and they can even improve your credit score. A credit card will allow you to use the bank or lenders money for everyday purchases and keep your money in the bank earning or offsetting interest for as long as possible.

But there in lies the catch. You should only be spending an amount that you can easily pay off. Then before the due date each month transfer the funds to reset your credit card balance. Your credit score will increase by arranging your finances this way.

5. Consolidate your debts

Consolidating your debts can make repayments easier as it combines many into one. It also means that you can pay off a number of debts at once, which will show positively on your credit score.

However, in saying this there are drawbacks, so the best way to find out if debt consolidation will work for you is to speak to a financial advisor first.

Are you concerned about the impact your credit score will have on finance approval? Our friendly team at MoneySmith can answer any questions you have and help you develop a plan for improving your credit score. Call us today on 1300 788 552.